real property gain tax act

Tax Act of 2008 a rental property converted to a. 2 the term covered mortgage obligation means any indebtedness or debt instrument incurred in the ordinary course of business that-- A is a.

Three Different Routes To Save Tax On Long Term Capital Gains Mint

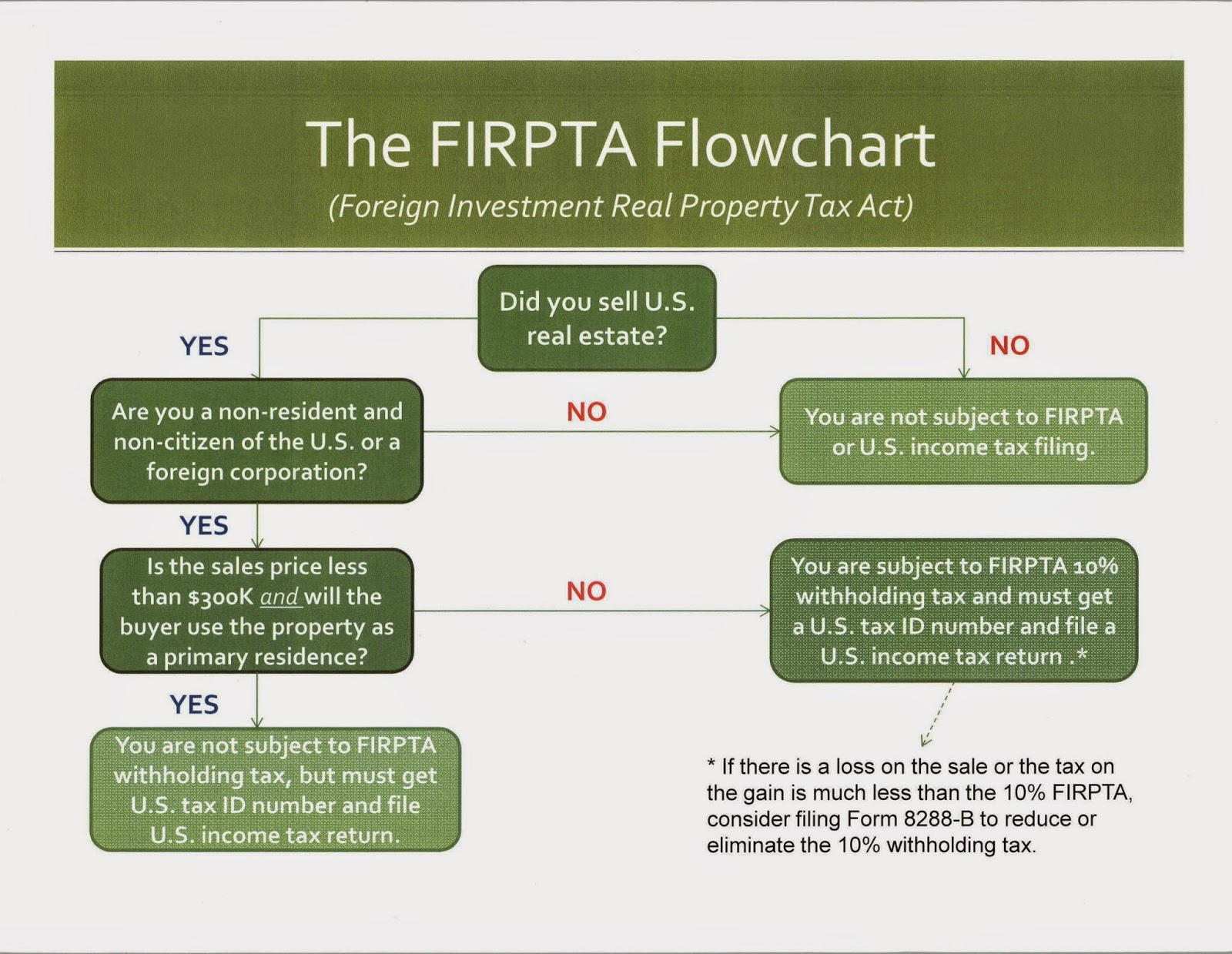

This IRM supersedes IRM 46112 Foreign Investment in Real Property Tax Act dated May 1 2006.

. Under Section 1031 of the United States Internal Revenue Code 26 USC. The tax on the gain can be. Audience LBI SBSE WI Effective Date 05-24-2019.

You cant recognize a loss. The Tax Cuts and Jobs Act TCJA changed deductions depreciation expensing tax credits and other tax items that affect businesses. Find research resources and locate an attorney specializing in research.

In 2014 the IRS issued Notice 2014-21 2014-16 IRB. HM Treasury is the governments economic and finance ministry maintaining control over public spending setting the direction of the UKs economic policy and working to achieve strong and. The frequently asked questions FAQs below expand upon the examples provided in Notice 2014.

L1963 c172 as amended NJAC. Long-Term Capital Gains Tax Rates. 636a as added by section 1102.

Civil Union Act PL 2006 c103 effective 21907. Vacant house property is considered as self-occupied in regards to the purpose of income tax. Before 1986 and from 2004 onward individuals were subject to a reduced rate of federal tax on capital gains called long-term capital gains on certain property held more than 12 months.

With the new Tax Cuts and Jobs Act this analysis is far less impactful because all income from the sale of IP is now ordinary. Tax is imposed at regular tax rates. When you own something for less than a year and sell it for a profit that profit is taxed at your normal income tax rateThat applies to flipping real estate restoring and selling vintage cars day trading antique flipping anything that involves buying low and selling high.

Upon a sale for a 200000 purchase price the total gain is 65000 but 15000 was ordinary income because it represented recapture of previous amortization. Part III computes the amount of gain required to be reported on the tax return in the current year if cash or property that isnt of a like kind is involved in the exchange. An Act to amend An Act to amend the Canada Elections Act and the Income Tax Act Bill C-4 assented to 2006-05-11 SC 2005 c 47 An Act to establish the Wage Earner Protection Program Act to amend the Bankruptcy and Insolvency Act and the Companies Creditors Arrangement Act and to make consequential amendments to other Acts.

Except for capital gain from the sale or exchange of real property owned and used by the claimant as his. Under the Tax Cuts and Jobs Act Section 1031 now applies only to exchanges of real property and not to exchanges of personal or intangible property. Research lawyer attorneys law and legal research information.

If as part of the exchange you also receive other not like-kind property or money you must recognize a gain to the extent of the other property and money received. The remaining 50000 was long-term capital gain. State income tax is due on the gain from the sale whether the seller is a resident part-year resident or nonresident.

If property was acquired on an exchange described in this section section 1035a section 1036a or section 1037a then the basis shall be the same as that of the property exchanged decreased in the amount of any money received by the taxpayer and increased in the amount of gain or decreased in the amount of loss to the taxpayer that was recognized on such exchange. CIVIL UNION PARTNER NJSA. 1031 a taxpayer may defer recognition of capital gains and related federal income tax liability on the exchange of certain types of property a process known as a 1031 exchangeIn 1979 this treatment was expanded by the courts to include non-simultaneous sale and purchase of real estate a.

5 1980 is a United States tax law that imposes income tax on foreign persons disposing of US real property interests. Gains on real property exchanged for like-kind property are not recognized and the tax basis of the new property is based on the tax basis of the old property. The domestic borrower realizes a gain on the sale of the property.

The property tax rate. The Townshend Revenue Act were two tax laws passed by Parliament in 1767. If you only invest part of your eligible gain in a QOF you can elect to defer tax on only the part of the eligible gain that was invested in this way.

Before the law change section 1031 also applied to certain exchanges of personal or intangible property. If you flip more than one or two properties in a year you. See Definition of real property later for more details.

Also from interest rent dividends securities or the transaction of any business carried on for gain or. Trades businesses commerce or sales or dealings in property whether real or personal growing out of the ownership or use of or interest in such property. Hold Properties for More Than a Year.

See Notice 2021-10 PDF for a special rule if the last day of your 180-day period was on or. 938 PDF explaining that virtual currency is treated as property for Federal income tax purposes and providing examples of how longstanding tax principles applicable to transactions involving property apply to virtual currency. A chargeable gain is a profit when the disposal price is more than the purchase price of the property.

And certain improvements to nonresidential real property allows an immediate deduction of 50 for equipment placed in service in 2017 40 in 2018 and 30 in 2019. Act 250 Disclosure Statement. The Foreign Investment in Real Property Tax Act of 1980 FIRPTA enacted as Subtitle C of Title XI the Revenue Adjustments Act of 1980 of the Omnibus Reconciliation Act of 1980 Pub.

If a domestic corporation which is or has been a United States real property holding corporation as defined in section 897c2 during the applicable period specified in section 897c1Aii distributes property to a foreign person in a transaction to which section 302 or part II of subchapter C applies such corporation shall deduct and withhold under subsection a a tax. Get the latest science news and technology news read tech reviews and more at ABC News. Youd pay a long-term capital gains tax on the difference between the cost basis and the sale amount if you owned the property for more than a year before selling and you earn more than 40400 as a single taxpayer in tax year 2021 or more than 41675 in 2022.

CLAIM FOR REAL PROPERTY TAX DEDUCTION ON DWELLING HOUSE OF QUALIFIED NEW JERSEY. Part of the gain is paid to the foreign lender as contingent interest in satisfaction of a debt instrument. The 1031 exchange allows for the tax on the gain from the sale of a property to be deferred rather than eliminated.

Vermont Withholding Tax Return for Transfer of Real Property from the buyer at the real estate closing. Income from House Property. What most people dont know is that RPGT is also applicable in the procurement and disposal of shares in companies where.

Another head in the Income Tax Act this clause shed light and detail about the taxation policy on the house or real estate that you as a tax payer are residing in. A Definitions--In this section-- 1 the term covered loan means a loan guaranteed under paragraph 36 of section 7a of the Small Business Act 15 USC. Based on the Real Property Gains Tax Act 1976 RPGT is a tax on chargeable gains derived from the disposal of property.

Uniform Capacity Tax and Solar Plants.

What Is The Effect Of A Lower Tax Rate For Capital Gains Tax Policy Center

Real Property Gains Tax Rpgt In Malaysia 2022

Solved A The Real Property Gain Tax Rpgt Act 1976 Specify Chegg Com

Real Property Gains Tax Valuation And Property Management Department Portal

Real Property Gains Tax Act 1976 Act 169 Selected Orders As At 15th April 2022 Shopee Malaysia

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important

When Does Capital Gains Tax Apply Taxact Blog

Real Property Gain Tax Summary Conveyancing Law 1 Real Property Gain Tax Question Mainly Regards Studocu

Real Property Gains Tax Act 1976 Jordyndsx

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

Capital Gains Tax In The United States Wikipedia

State Taxes On Capital Gains Center On Budget And Policy Priorities

Property Law In Malaysia Real Property Gains Tax Rpgt For Disposal Of Properties Chia Lee Associates

216 2020 217 2020 Amp 218 2020 Gazettes Of Mahwengkwai Real Property Gains Tax Pdf4pro

Capital Gains Tax What It Is How It Works And Current Rates

Expats And Capital Gains Tax On Mexican Real Estate Mexlaw Real Estate Law

Real Property Gains Tax Act 1976 Act 169 Selected Orders As At 15th April 2022 Lazada

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

0 Response to "real property gain tax act"

Post a Comment